$25,000 or More Debt Consolidation Relief for Credit Card Holders - from America’s top debt relief company

We’re your debt relief partners, every step of the way

Consolidate multiple payments into one

Fast, Easy Application

Pay Less, Save More - Cut debt faster and save on interest.

Get a plan that fits your budget and goals.

Our team negotiates and guides you.

TO QUALIFY YOU MUST HAVE:

✅ Over $25,000 in Credit Card Debt

✅ A Consistent Source of Income

Consumer approved and industry recognized.

NO HIDDEN FEES

Get A Free, No-Obligation

Debt Relief Consultation

✅ Get A Free Savings Estimate Today

✅ See How Quickly You Can Be Debt Free

✅ No Fees Until Your Accounts Are Settled

Top-Notch Reviews From Our Top-Notch Clients

How It Works

You’re in control, our debt experts do the work.

Talk to us for a free consultation

Tell us about your situation, and we’ll walk you through your best debt relief options—no obligation.

We create a Personalized Plan that works for you

We’ll craft an affordable plan tailored to your needs. You approve it, and we handle the rest.

Faster Debt Freedom

Break free from debt faster than you thought possible and regain control of your finances.

Ready to get started?

We’ve transformed the lives of more than 12,000 people

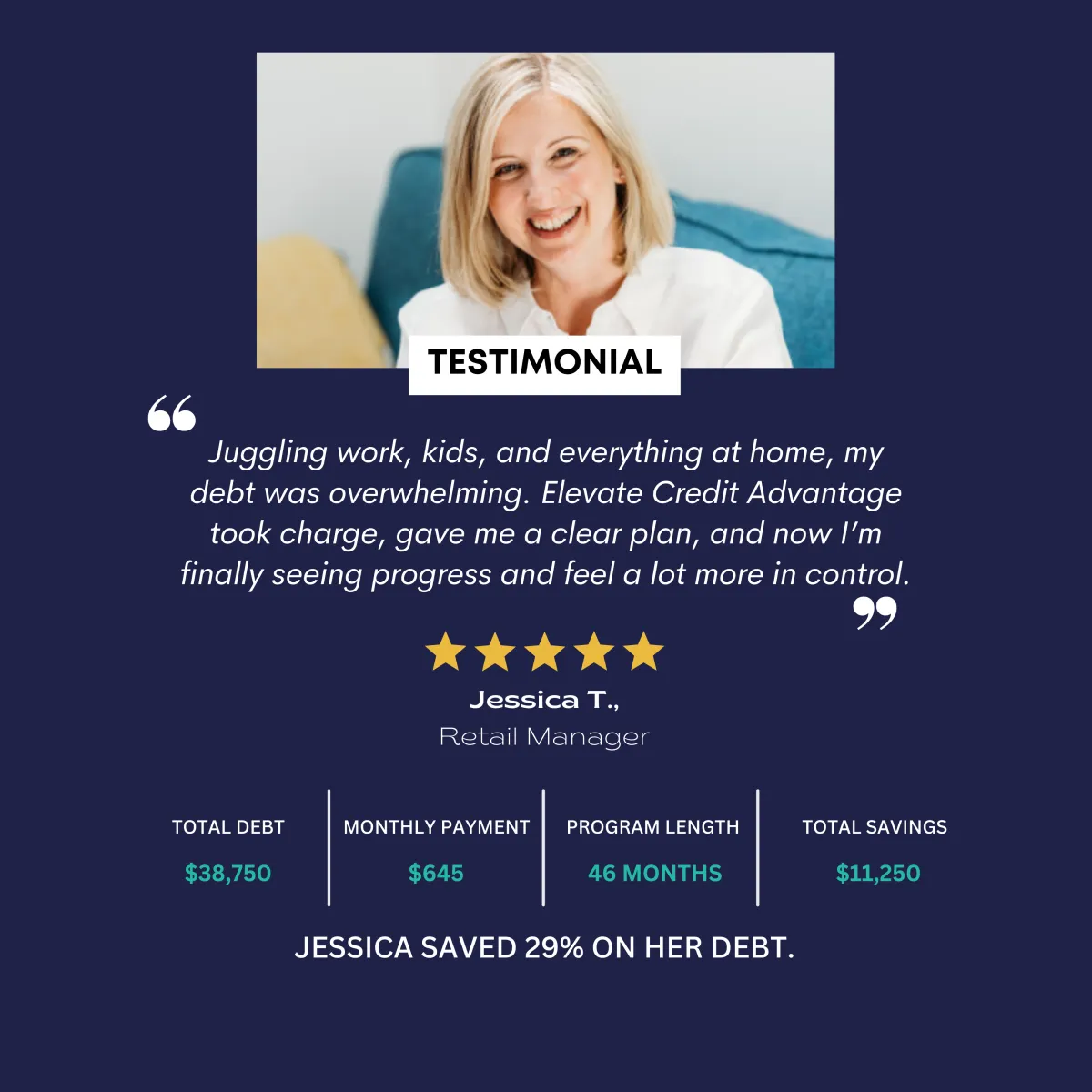

Here’s what some of our clients have to say:

I reached out to Elevate Credit Advantage after a friend recommended them. The team walked me through my options, and I found a plan that actually worked for my family. The relief I feel now is incredible—thank you, ECA!

💳 Total Debt: $28,500

💰 New Monthly Payment: $475

🎯 Estimated Savings: 30%

⭐️⭐️⭐️⭐️⭐️

Charles A.,

Small Business Owner

I felt stuck—paying hundreds every month but barely making a dent in my debt. The team helped me find a plan that actually worked, and now I can finally see a clear path to financial freedom. I only wish I had done this sooner!

💳 Total Debt: $32,745

💰 Monthly Payment: $512

🎯 Savings: 27%

⭐️⭐️⭐️⭐️⭐️

David J.,

Sales Representative

Juggling bills, rent, and credit card payments felt impossible. I was skeptical at first, but they helped me find a plan that actually made sense for my budget. Now, I can finally breathe again knowing I’m on the right track.

💳 Total Debt: $28,390

💰 Monthly Payment: $468

🎯 Savings: 25%

⭐️⭐️⭐️⭐️⭐️

Lisa M.,

Single Mom & Nurse

Why Choose Elevate Credit Advantage?

At Elevate Credit Advantage, we understand the weight of financial stress, and our mission is to help you regain control over your debt and credit. We offer tailored debt relief solutions designed to simplify your financial journey, helping you achieve long-term success.

Personalized Debt Solutions: We create a custom plan that aligns with your specific needs, taking into account your income, goals, and debt situation.

Debt Consolidation Made Easy: We simplify your finances by consolidating multiple debts into one manageable payment, allowing you to focus on rebuilding your financial health.

Expert Negotiation on Your Behalf: Our experienced team negotiates with creditors to reduce your debt and lower your monthly payments, saving you money and easing financial burdens.

Comprehensive Financial Guidance: We provide expert advice every step of the way, ensuring you understand your options and make informed decisions to set you up for future success.

Our Commitment to You

we take pride in our ability to empower our clients to regain financial control. Our team of experts works tirelessly to ensure that each client receives a personalized and effective solution that fits their unique circumstances. With us by your side, you’ll have the guidance and support needed to overcome financial challenges and move toward a debt-free future.

Your Success is Our #1 Priority

Are You Ready to Take Control of Your Debt?

Our fees are 100% success-based – we don’t get paid until we have helped you achieve a solution for your debt.

Frequently Asked Questions

Who is Elevate Credit Advantage, and Why Should I Trust You?

At Elevate Credit Advantage, trust is the foundation of everything we do. We understand that debt can feel overwhelming, and finding the right solution requires a team that truly listens. That’s why we focus on understanding your unique financial situation before offering a personalized debt relief plan that works for you.

Our commitment to transparency and client success sets us apart. We follow through on our promises, always acting in your best interest. Elevate Credit Advantage is proud to be a trusted provider of debt relief services, helping thousands of individuals take control of their financial future.

Our reputation is backed by real results and industry recognition:

✅ Thousands of clients successfully enrolled in our programs

✅ Millions in debt resolved for individuals and families

✅ Highly rated by satisfied clients who have regained financial stability

We adhere to the highest ethical standards in the industry and work with accredited professionals to ensure you receive the best possible guidance. With Elevate Credit Advantage, you’re not just another case—you’re a person with a future worth investing in. Let us help you take the first step toward financial freedom today.

How Does Debt Relief Work with Elevate Credit Advantage?

At Elevate Credit Advantage, our debt relief program is designed to give you immediate financial relief and help you take control of your debt. Our goal is to reduce your monthly payments, eliminate stress, and get you on the path to becoming debt-free—fast and affordably.

Here’s how it works:

Dedicated Savings Account: Instead of paying your creditors directly, you’ll make a manageable monthly payment to a Dedicated Savings Account that’s in your name and under your control. This helps relieve cash flow pressure while still saving for your debt relief.

Negotiating with Creditors: As your funds accumulate, we’ll step in to negotiate with your creditors to lower your balances. Creditors prefer a reduced payment over the risk of receiving no payment at all, which gives us leverage to secure the best possible deal for you.

Paying Off Your Debt: Once a negotiation is finalized, we’ll use the funds in your Dedicated Savings Account to pay your creditors the agreed-upon, reduced amount. As we pay off each debt, it will be reported as a zero balance, and you’ll see your progress toward a debt-free future.

With Elevate Credit Advantage, you’re never alone in this journey. Our team works tirelessly to ensure that you get the best possible debt relief options, and we guide you every step of the way to financial freedom.

Can I Afford This?

At Elevate Credit Advantage, we go the extra mile to ensure that our debt relief solution fits comfortably within your budget. We don’t just look at your ability to pay us—we take the time to carefully review your financial situation to ensure the solution we recommend will truly ease your burden.

With flexible payment options, you can customize your deposit schedule to match your cash flow, making it easier to stay on track and feel in control throughout the entire process. Our goal is to help you get debt-free while making the journey as manageable and stress-free as possible.

How Much Do Your Services Cost?

At Elevate Credit Advantage, we believe in transparent, performance-based pricing. That means we don’t charge you until we’ve achieved real, meaningful results for you. We don’t earn anything unless you feel great about the savings and progress we’ve helped you make toward becoming debt-free.

Our fees are based on the amount of debt you enroll in our program, typically up to 25% of your total debt. Given the amount you could save by reducing your debt versus continuing to pay high interest rates, our service often results in significant savings.

For example, one of our recent clients came to us with over $30,000 in credit card and unsecured debt. They were paying nearly $1,500 a month in minimum payments. After working with us, they were able to set up a manageable monthly deposit and save approximately 40% on their total debt.

Here’s how that breaks down:

Client

Total Debt: $30,000

Previous Monthly Payments: $1,500

New Estimated Monthly Payment: $600

Potential Savings: Over $12,000

This scenario illustrates how much you can save by working with Elevate Credit Advantage. Each plan is customized to fit your financial situation, and we ensure you can feel confident and in control throughout the process.

Call

866-507-0340

Email: [email protected]